What's Going on in the Markets March 25, 2018

Sunday, March 25, 2018 at 6:42PM

Sunday, March 25, 2018 at 6:42PM With the threat of a trade war, the appointment of a new National Security Advisor, and potential war drums being pounded, the markets took a pounding of their own last week. After a robust recovery, the stock markets now seem intent on re-testing the February 8th lows.

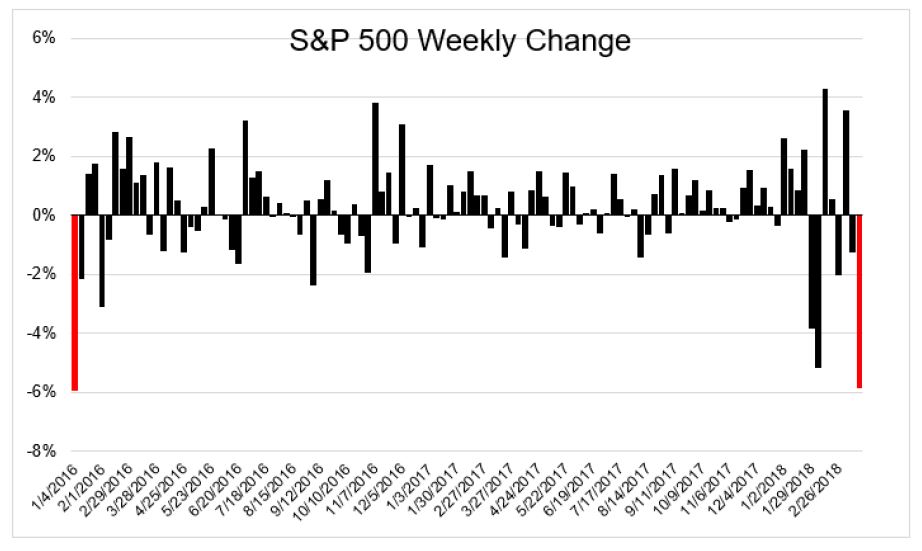

As stocks went on sale again, there didn’t seem to be a lot of bargain hunters stepping in to take advantage of the lower prices. The S&P 500 lost 5.9% over five days, its worst week since January 2016.

This action follows a by-now-familiar pattern: the Trump Administration announces tariffs—this time on Chinese imports with an estimated value of $60 billion a year—but is not specific on the details. Traders fear that there will be retaliation against American products sold abroad, and put a lower value on the large multinational companies that account for most exports and make up most of the major indexes.

The last time this happened, the tariffs involved steel and aluminum, and the panicked sellers later discovered that the impact on global trade was actually quite small, due to negotiated exemptions for major steel producing nations like Canada and South Korea—plus the Euro-zone and Mexico. This time around, the U.S. trade representative has 15 days to develop a list of specific Chinese products to slap the additional taxes onto, and there will be a public comment period before the threatened tariffs go into effect. China has announced that it is developing its own list, and as companies (and farmers) become aware of what is included in its reported $3 billion tariff package, they will lobby for exemptions which may turn this announcement into another tempest in a teapot.

Meanwhile, in the wake of the Cambridge Analytica scandal, admissions that private information on 50 million people had been pilfered, and up to 126 million Americans had seen posts by a Russian troll farm on its site, Facebook shares fell almost 10%, from $176.83 down to $159.39. This took the social media giant down from the 5th largest-capitalization company in the S&P 500 index to the 6th (behind Berkshire Hathaway)—dragging the index down even further.

What’s remarkable about the selloff over things that might or might not happen, is that it came amid some very good news about the U.S. economy. Durable-goods orders jumped 3.1% in February, sales of newly-constructed homes were solid, and Atlanta Fed president Raphael Bostic announced that there were “upside risks” in GDP and employment. Translated, that means that the economy is looking too good to keep interest rates as low as they have been—which means this is a curious time to be selling out and heading for the investment sidelines.

Of course, that doesn't mean that the market can't "correct" further. As the market tests the February 8 lows, an overshoot to a new low cannot be ruled out, but all the selling last week is at least arguing for a robust bounce, which I expect to materialize this week. The quality and durability of that bounce will tell us a lot about the strength of the market going forward.

The week before the Easter holiday tends to be seasonally bullish, as long as cooler heads prevail. If you haven't lightened up your portfolio risk in a very long time, and feel the need to reduce your stock fund exposure, that may be a better time to lighten up your risk. Heck, if you're under-exposed to stocks, this may be a good place to pick up some of your favorite names at a discount. Disclaimer: this is not a recommendation to buy or sell any securities.

For our clients, we have reduced exposure to some overvalued stocks and funds over the past several weeks, increased exposure to some undervalued ones, and have increased our hedges to reduce our overall risk. For the most part, however, the benefit of the doubt goes to this bull market until economic and market conditions change drastically.

Whatever you do, don't panic as a result of the headlines. There's always a better time to sell, and that's not into the teeth of a headline driven sell-off. As I've said before, market volatility is the price we pay for the superior returns of stocks, and now that's what we're paying for. Stocks can only give you superior returns if you don't panic out of them at the first sight of turbulence.

If you would like to review your current investment portfolio, your level of risk. or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Sources:

http://theirrelevantinvestor.com/2018/03/23/8750/

https://www.usatoday.com/story/money/2018/03/22/stock-market-falls/448665002/

http://www.symbolsurfing.com/largest-companies-by-market-capitalization

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post