Higher Interest Rates: One and Done or More to Come?

Thursday, December 22, 2016 at 11:42AM

Thursday, December 22, 2016 at 11:42AM We all know that we're paying more for almost everything these days. Everything, of course, except money. Interest rates have been at historical lows for more than eight years, even though the economy has steadily improved over this period.

So anybody who was surprised that the Federal Reserve Board (A.K.A. The Fed) decided to raise its benchmark short-term interest rate last week probably wasn’t paying attention. The U.S. economy is humming along, the stock market is booming and the unemployment rate has fallen faster than anybody expected. The incoming administration has promised lower taxes and a stimulative $550 billion infrastructure investment. The question on the minds of most observers is: what were they waiting for?

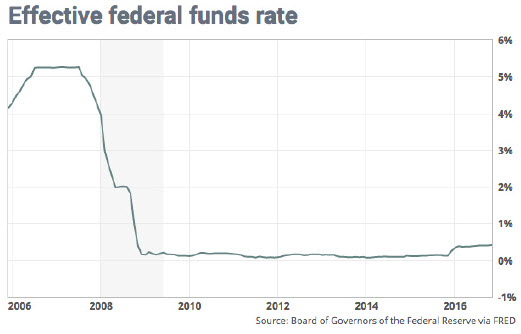

The rate rise is extremely conservative: up 0.25%, to a range from 0.50% to 0.75%—which, as you can see from the accompanying chart, is just a blip compared to where the Fed had its rates ten years ago.

The bigger news is the announced intention to raise rates three times next year, and move rates to a “normal” 3% by the end of 2019—which is faster than some anticipated, although still somewhat conservative. Whether any of that will happen is unknown; after all, in December 2015, the Fed was telegraphing four rate adjustments in 2016 , before backing off until now with just this one. Personally, I believe that three interest rate increases in 2017 will prove inadequate, especially if current signs of inflation intensify next year.

The rise in rates is good news for those who believe that the Fed has intruded on normal market forces, suppressed interest rates much longer than could be considered prudent, and even better news for people who are bullish about the U.S. economy. The Fed may have been the last remaining skeptic that the U.S. was out of the danger zone of falling back into recession; indeed, its announcement acknowledged the sustainable growth in economic activity and low unemployment as positive signs for the future. However, bond investors might be less pleased, as higher bond rates mean that existing bonds lose value. The recent rise in bond rates at least hints that the long bull market in fixed-rate securities—that is, declining yields on bonds—may finally be over.

For stocks, the impact is more nuanced. Bonds and other interest-bearing securities compete with stocks in the sense that they offer stable—if historically lower—returns on your investment. As interest rates rise, the see-saw between whether you prefer stability or future growth tips a bit, and some stock investors move some of their investments into bonds, reducing demand for stocks and potentially lowering future returns. None of that, alas, can be predicted in advance, and the fact that the Fed has finally admitted that the economy is capable of surviving higher rates should be good news for people who are investing in the companies that make up the economy. That's not to say that the prospect of more interest rate hikes won't cause volatility in the stock markets.

So there may be a lump of coal on the list for over-exuberant investors in the year ahead. Although the current weight of evidence points to a continuation of this economic recovery, pressures that have been synonymous with trouble in past cycles have been developing. Wage and commodity (oil, raw materials) price increases may be rising faster than anticipated, and the Fed could easily fall behind in their efforts to keep inflation in check.

The bottom line here is that, for all the headlines you might read, there is no reason to change your investment plan as a result of a 0.25% change in a rate that the Fed charges banks when they borrow funds overnight. There is always too much uncertainty about the future to make accurate predictions, and today, with the incoming administration, the tax proposals, the fiscal stimulation, and the real and proposed shifts in interest rates, the uncertainty level may be higher than usual.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Sources:

http://www.businessinsider.com/fed-fomc-statement-interest-rates-december-2016-2016-12

http://www.marketwatch.com/story/fed-to-hike-interest-rates-next-week-while-ignoring-the-elephant-in-the-room-2016-12-09

http://www.reuters.com/article/us-usa-fed-idUSKBN1430G4

http://www.usatoday.com/story/money/personalfinance/2016/12/15/fed-rate-hike-7-questions-and-answers/95470676/?hootPostID=32175354f7440337d62a767b3db92c68

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post

Reader Comments