Celebrity Apprentice - Presidential Edition

Wednesday, November 9, 2016 at 9:23PM

Wednesday, November 9, 2016 at 9:23PM Can lightning strike twice? Apparently it can as pundits, oddsmakers and major polls got it all wrong when forecasting our choice for our next president. Most had Clinton winning in a landslide. The first lightning instance was their wrong call on the Brexit vote earlier this year.

With President Elect Donald Trump, you may be well advised to prepare for a potentially wild ride in the investment markets over the next few weeks; indeed, the markets turned sharply negative in the overnight futures market Tuesday due to the uncertainties ahead. However, the day after the election (Wednesday), the markets closed decisively higher than election day in an opposite reaction to a market crash which some warned about if Trump was elected.

Questions Abound: Will the new President really build an expensive wall across our Southern border? Will he introduce legislation that will nullify the Affordable Care Act and throw millions of Americans with pre-existing health conditions into health insurance limbo? Do taxpaying non-citizens who have children born in America have reason to fear deportation? Are our allies abroad really going to have to renegotiate their trade and security arrangements with the world’s superpower? Will he even the score with his government adversaries, invite them into his boardroom, and tell them "You're fired"?

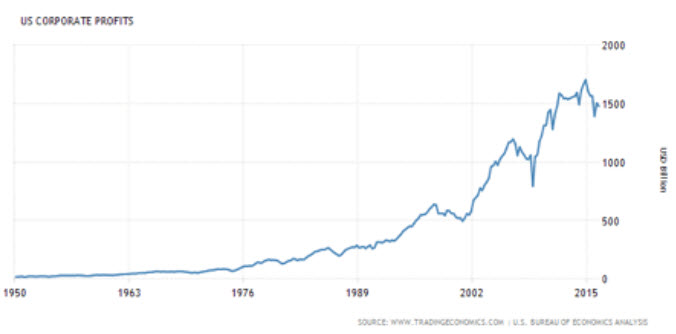

It is helpful to remember that market gyrations are almost always bad times to trade, and particularly to sell. We have more than two months before the new president takes office. Traders and analysts have plenty of time to settle down between now and the first 100 days of the Trump presidency, and evaluate whether America’s corporations are, indeed, worth much less than they were before election night (they're not). The safest bet you can make is that they may be unusually jumpy for the next four years. But in the end, the intrinsic value of stocks doesn’t change with the occupant of the White House.

One of the more interesting things to watch out for is a tax reform proposal sometime in early 2017. Along the campaign trail, candidate Trump proposed simplifying our taxes down to three ordinary income tax brackets: 12% (up to $75,000 for joint filers), 25% ($75,000 to $225,000) and 33% (above $225,000). The wish list includes a doubling of the standard deduction, with itemized deductions capped at $100,000 for single filers; $200,000 for joint filers. Capital gains taxes would be capped at 20%, federal estate and gift taxes would be eliminated and the step-up in basis would be eliminated for estates over $10 million.

However, one should remember that these proposals were made before anyone imagined that Americans would elect an undivided government, with the Presidency, the House and Senate all under the control of one party. The next four years—indeed, the first 100 days of the new Presidency—represent an opportunity for the Republican party to do something much more ambitious than simply tinker with our nation’s tax rules. Influential Republican leaders—including House Speaker Paul Ryan—have reportedly been planning for some years to rewrite our nation’s tax code.

What, exactly, would tax reform look like? At this point, we simply don’t know. The goal would be tax simplification, but the bet here is that whatever form this takes will add thousands of pages to the current law and will likely look very different from Trump's proposal.

Of course, everything is speculation at this point, which is the most important thing to keep in mind if the markets roil and the shock and awe of the unexpected election outcome begins to sink in and cooler heads prevail. The very worst thing you could do, over the next few days and weeks, is make a temporary loss permanent by selling into the general panic. Better yet, take advantage of others' panic and add to your investments at prices lower than they were during the past couple of years.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post.