It's My Turn to Retire-How do I Pay Myself?

Sunday, March 11, 2018 at 1:55PM

Sunday, March 11, 2018 at 1:55PM It's no surprise that more and more of my clients (and prospects) are coming to me as they approach retirement and are increasingly anxious about how to make the transition from accumulation of their retirement funds to distribution of those funds. Questions like "when should I claim social security, how much is safe to withdraw each year, what account should I take it from first, how will taxes affect my retirement, how should I safely invest during retirement, what should I budget for healthcare costs, what medicare plans are best for me?" are among the many questions on pre-retirees' minds.

With an estimated 10,000 people retiring every day, this unprecedented surge of new retirees is expected to last for the next 17 years. Many, perhaps most, will roll their retirement plan assets into an IRA account, and that money--plus Social Security, possibly a small pension and any taxable retirement accounts they may have--will provide their living expenses for the rest of their lives.

This is different from retirees in the past, who often received regular sizeable payments from their defined benefit plans--their equivalent of a retirement paycheck. Millions of new retirees are being required to make a new kind of calculation: how do I translate a lump sum retirement account into sustainable income over the rest of my retirement? For those of us who are accustomed to receiving income throughout our lives, this is not an easy calculation to make.

Suppose, for example, a 65-year-old couple retires, and when their pension assets are rolled into the IRA, they have a total of $4 million between the IRA and their retirement accounts. They can start receiving $1,750 a month from Social Security. With so much money in the bank, they feel comfortable joining an expensive country club, traveling around the globe, and before long, a large recreational vehicle is parked in their driveway. They remodel the kitchen. By age 68, they still have $2.5 million in the bank and are back down to spending $170,000 a year (including taxes). Are they all right, or not?

This is the kind of calculation that financial planners who serve retiree couples wrestle with all day long, and there are few definitive answers. Some of the pioneering research into safe spending in retirement, most notably by Bill Bengen of La Quinta, CA, take into account what is called "sequence risk"--meaning that some unlucky retirees will experience a severe market drop in their early years, which will make it more likely that they'll run out of money before they die. The research assumes that the retired couple wants to raise spending, each year, at exactly the inflation rate, so they maintain spending power and overall lifestyle. Then it looks at the historical market returns, and identifies a spending level that would have survived even the worst sequence risk scenarios. The answer is between 4% and 4.5% of the retirement portfolio in the first year, with that dollar amount rising with the inflation rate each year (that approach requires retirement savings of approximately 20-22 times your annual lifestyle budget expected in retirement) .

In our hypothetical retiree example, Social Security is paying for $21,000 of the couple's living expenses, meaning the portfolio has to come up with an additional $149,000, indexed to inflation, for the next 30 or so years. That comes to almost exactly 6% of the remaining portfolio. The couple feels financially solvent, but they are really highly at risk if the market turns down in the next few years.

Other research, notably by Jon Guyton of Minneapolis, MN, has factored in the possibility that a retired couple will be willing to forego inflation increases in years when their retirement portfolio has lost money. This so-called "adaptive withdrawal" strategy allows a retiree couple to raise spending to approximately 4.8% of the initial portfolio. Once again, under this other scenario, our hypothetical couple is in the spending danger zone. And this only covers a 30-year period. People who live longer would need to live on somewhat less--but how do you know how long you'll live?

Others, including Jim Shambo of Colorado Springs, have looked at the Bureau of Labor Statistics research on actual spending in retirement, and found data that questions the assumption that people in retirement only increase their yearly spending by the inflation rate. Shambo found that the government-calculated Consumer Price Index appears to understate actual yearly increases in retirement spending by as much as one and a half percentage points a year--meaning if the CPI goes up by 3%, actual spending may rise by anywhere from 3.25% to 4.5%. Using a more complex calculation, Shambo found that people age 75 and older were spending between 13.2% and 22.07% more than the inflation statistics would indicate.

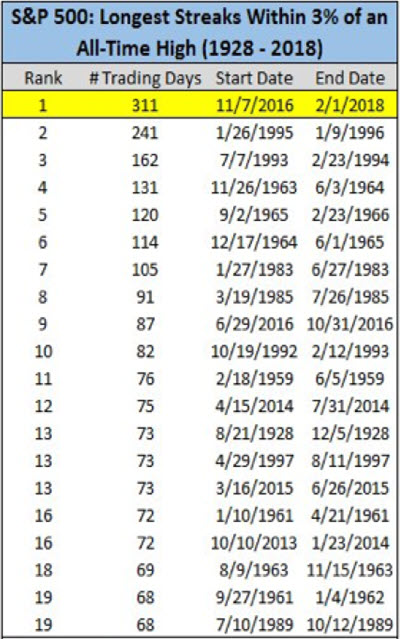

Of course, all of this research focuses on surviving the worst-case scenario--the times when the markets are least favorable to a comfortable retirement. If the market climate is, instead, sunny during the early years of retirement, if our hypothetical couple happened to retire in the early years of a bull market, then their current spending won't be a problem, and they may actually be able to increase their lifestyle expenditures.

Self-serving statement alert: The only way to stay in the safety zone is to have a professional run the numbers every year in light of recent market activity and long-term guidelines, and help you chart a course through the income maze. Converting a portfolio into a paycheck is a surprisingly complex exercise. Ten years down the road, when a few million baby boomers are well into retirement, you may be reading about some of the simple, innocent, tragic mistakes they made with their spending decisions when it felt as if they were flush with cash.

If you would like to review your retirement income options, current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Sources:

http://www.fpanet.org/journal/HowtoAchieveaHigherSafeWithdrawalRate/

http://www.advisorperspectives.com/newsletters12/The_Fallacies_in_Todays_Retirement_Plan_Assumptions.php

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post