The Present Doesn't Portend the Future

Sunday, May 6, 2018 at 9:32AM

Sunday, May 6, 2018 at 9:32AM You probably know the well worn disclaimer in the investing world, "past performance is no guarantee of future results." It's essentially how many investment firms wow you with statistics about their past performance, only to remind you that your future results may never match theirs. OK, fair enough, so how about present circumstances? Do they portend the future?

It's human nature to focus more on the present than the future, which is in line with our basic instinct of survival. After all, if we don't take care of the here and now, there may not be a future, right?

Marketing departments know this! Many things in life are about experiencing pleasure today, and pushing the cost of that pleasure into the future (credit cards anyone?). Drive off with the car with zero dollars down, and pay over 84 months. Go ahead--have another piece of cake - you can work it off later. No problem.

Many decisions investors face have similar tradeoffs. Buy a new car, or put more money into retirement? Take another vacation or fund the college account? And the further out the consequence, the less weight we tend to give to it. This is because we have a hard time imagining the future…especially way into the future.

Smart Today May Not Be Smart Tomorrow

We tend to extrapolate the present into the future, as if things will never change and will continue the status quo.

In the financial crisis of 2008-2009, many people were selling after experiencing financial losses. Some of that selling came just weeks before the market hit bottom. What would cause an investor, who desires to buy low and sell high, to sell after experiencing significant (yet unrealized) losses (i.e. sell low)? One factor is that they were extrapolating the present into the future…they couldn’t see how things would change.

Another great example is the German Bund (treasury bond). In 2016, Germany sold the 10-year Bund at a negative yield (this means that buyers were guaranteed to get back less principal than they originally put in). Those investors were certain that rates would continue going negative for the next 10 years. But here we are almost two years later and the current yield is already over +0.50%. Substantial money (principal) may be lost on this bond simply because investors extrapolated the "present of 2016" into the future.

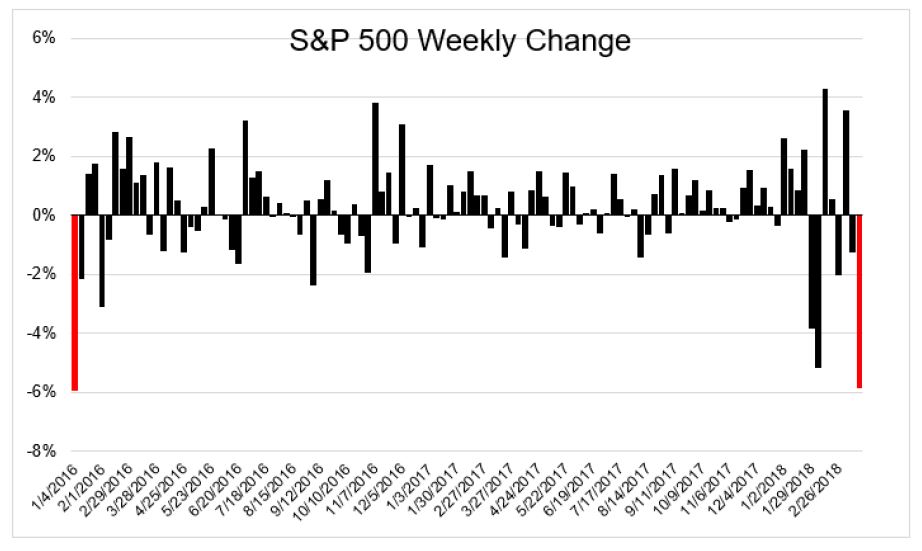

More recently, the stock markets have struggled to continue the torrid advance that began with the presidential election in 2016, lasting through this past January. The markets had a handful of "1% days" during a low volatility year in 2017, yet so far in 2018, we've had more 1% days than all of 2017 as volatility has returned. While the markets haven't yet closed more than 10% from their January peak, you've probably read or heard the prognosticators calling this correction the beginning of the end for the bull market. Enough investors will be scared witless of enduring another 2008-2009 selloff that they'll sell now and probably miss the next great advance that makes another new all-time high sooner than they can presently imagine.

History May Help Here

Think about everything that has happened in the last 10 years--of course, a lot has happened. And while we may not be able to project what will happen in the future, how it will happen or when, we know – through the history of mankind - that lots of unexpected things will occur. Another crisis is always bound to come along.

The plans that we have developed for our clients prepare them for many different scenarios. They take into account their risk tolerance, time-frame and overall monetary goals and dreams. But we don’t have to get any one scenario right. We just need to be disciplined enough to stick with the plan through both the good and the tough times.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Source: Information obtained from The Emotional Investor